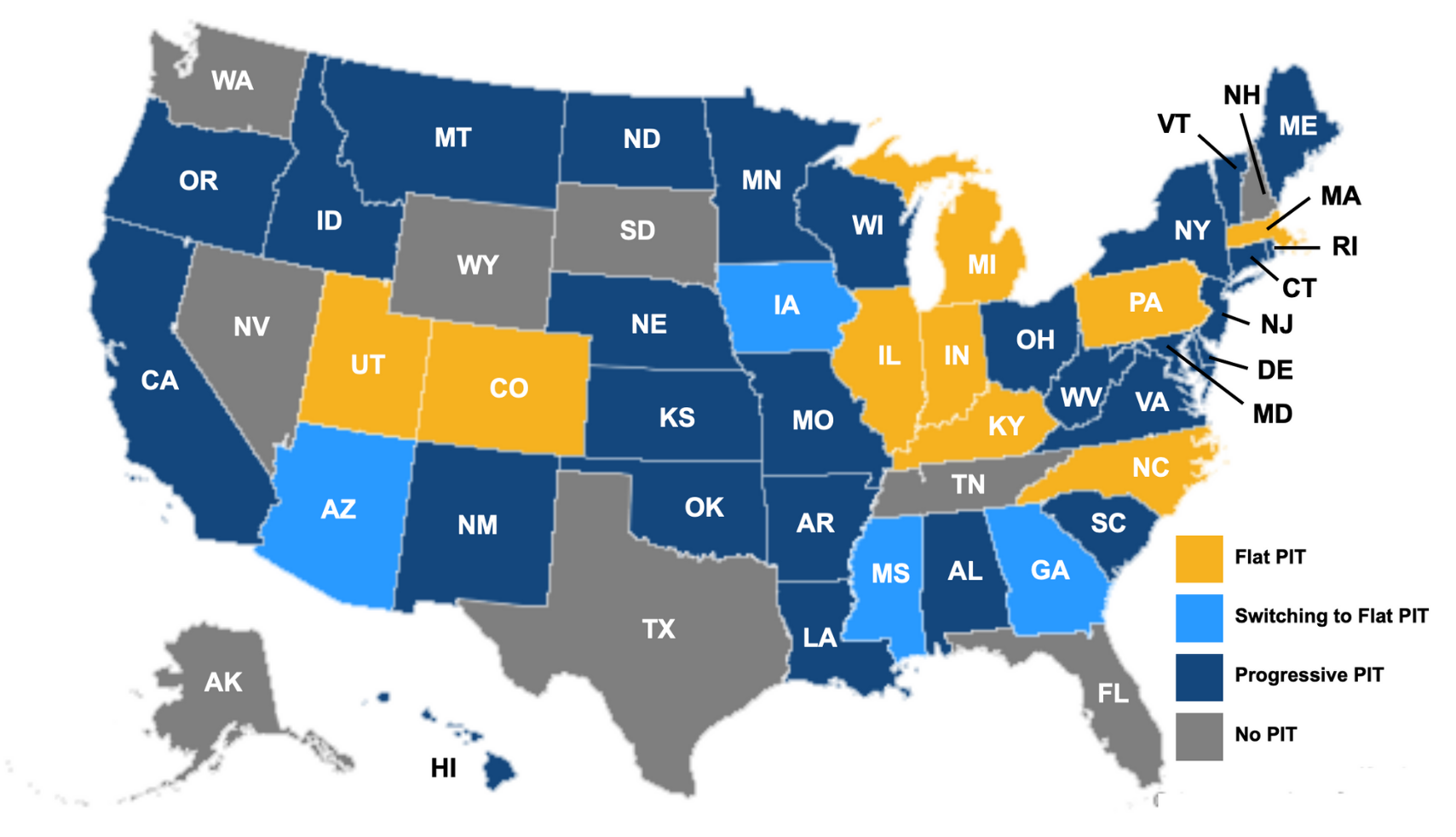

The Problem: Wisconsin’s most intense economic competitors are the states closest to us. Most of our neighbors have a flat income tax or are moving towards one. In contrast, Wisconsin, has a highly progressive state income tax that exempts the first $25,100 that a married couple earns or the first $12,550 a single person earns. In a state with a flat tax, there is only one income tax rate for all state taxpayers though quite often the first few thousand dollars of income is exempt from taxation. In a state with a progressive income tax, the income tax rate increases as people make more money. This can be particularly burdensome to the self-employed and small business owners because they usually pay personal income taxes on the income their business generates.

It will probably surprise many readers to learn that Illinois, Indiana and Michigan all have a flat income tax at rates much lower than Wisconsin. This year, Indiana decided to lower their flat tax rate to 2.9% over the next seven years. Also this year, Iowa which had a progressive income tax like Wisconsin’s with rates ranging from 0.33% to 8.53% has decided to move towards a flat tax rate of 3.9% by 2026. Take a look at the state income tax rates of our neighbors and you can see why Wisconsin needs to lower and flatten state income taxes.

| State | Income Tax Rate |

| Illinois | 4.95% |

| Indiana 2022 | 3.20% |

| Indiana 2029 | 2.90% |

| Michigan | 4.25% |

| Iowa 2022 | 0.33% – 8.53% |

| Iowa 2026 | 3.90% |

| Minnesota | 5.35% – 9.85% |

| Wisconsin | 3.54% – 7.65% |

The Solution: Wisconsin should lower and flatten its income tax rates in order to meet the competition of our neighbors. One way of doing this would be to keep or raise Wisconsin’s standard income tax deduction while gradually merging each of the income tax brackets from the bottom up so that the 3.54% rate paid by Wisconsin’s lowest income taxpayers is eventually enjoyed by all taxpayers. This would ensure that everyone would benefit from lower taxes but the reductions would come first for working class and middle class taxpayers. Wisconsin’s taxpayers need permanent tax reductions not one time tax rebate gimmicks.

Resources:

https://www.nerdwallet.com/article/taxes/state-income-tax-rates